By News Room

Government may form a panel to make a list of Public Sector Banks (PSU Banks) for privatization. The government also wants to consider its strategy regarding privatization of PSU banks.

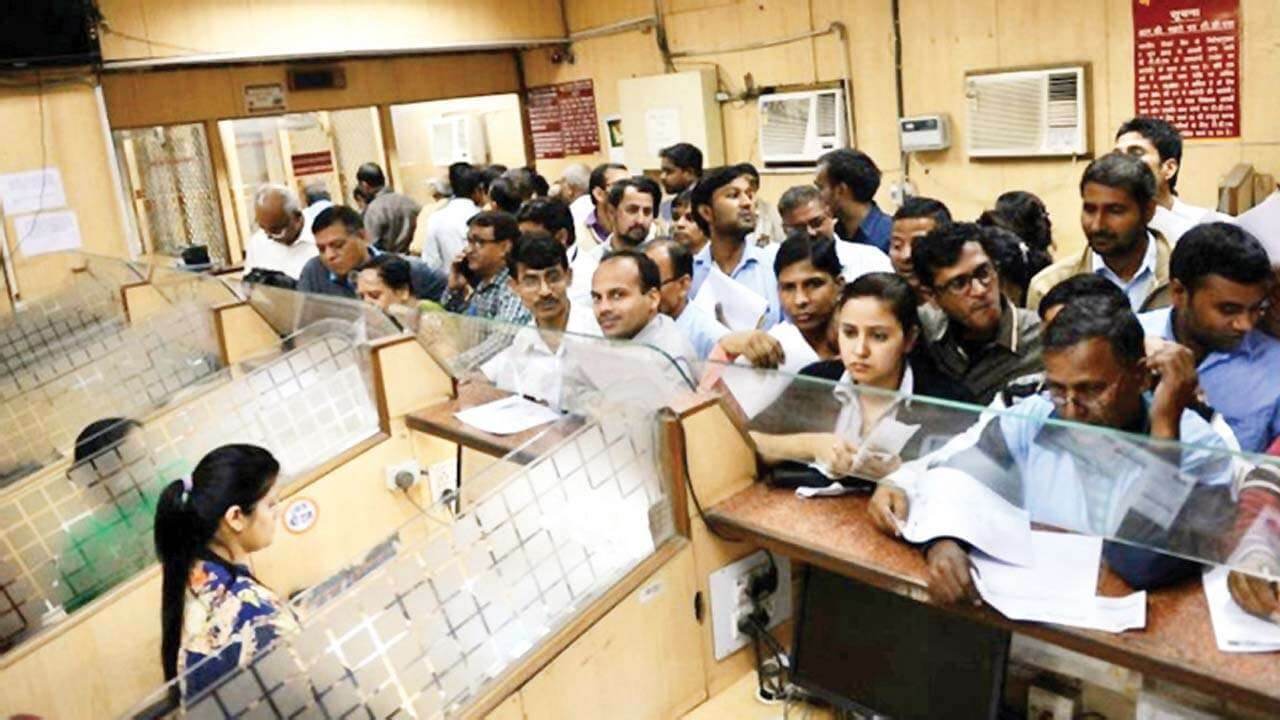

The health of banks, especially public sector banks, has improved significantly in the last few months. Many public sector banks are now in profit. The number of public sector banks has also reduced after the earlier privatization. Economic Times has given this news.

These banks were marked for privatization

In April 2021, NITI Aayog recommended privatization of Central Bank of India and Indian Overseas Bank to the Department of Disinvestment. However, a final decision could not be taken in this regard. “A committee may be formed to identify banks for privatisation,” an official told ET. This will include medium and small-sized banks.

Based on their performance, a decision will be taken to sell the government’s stake in them. During this, attention will also be given to other parameters including their bad loan portfolio.

Representatives of these departments will be in the panel

The panel could have officials from the Department of Investment and Public Asset Management (DIPAM), RBI and NITI Aayog. A government official said, “Privatisation of banks is at the top of the agenda. Now all the banks are in profit. So it is important to re-think which banks can attract potential investors. The privatization process is expected to focus on 12 smaller banks. These include Bank of Maharashtra and UCO Bank. For the time being, big banks will not be considered.

The Finance Minister had announced the privatization of two banks.

Finance Minister Nirmala Sitharaman in her 2021 budget speech had announced the privatization of two banks as part of the government’s disinvestment programme. The government had also prepared the Banking Laws (Amendment) Bill 2021. But, it has not yet been introduced in the Parliament.

Plan to merge small banks to form a big bank

The government has so far adopted the policy of merging small public sector banks to form big banks. Under this policy, many small banks have been merged with big banks in the last few years. Allahabad Bank, Andhrabank, Syndicate Bank are examples of this.

(pc rights of employees)

Read the Latest India News Today on The Eastern Herald.